car lease tax benefit

For the most part they remain as before. Car lease payments arent always tax deductible but with business leasing you can reclaim up to 100 of VAT.

Http Usedcommercials Ie To Buy Or To Lease A Truck Which Is Better For My Business Taxes Trucking Business Trucking Companies Business Tax

There are two issues here if you purchase a car in the name of the business and you use the car for work and business purposes then the use of the car will be deemed to be a fringe benefit in your hands and you will be taxed on this.

. Instead of paying sales tax in a lump sum payment at. Because your business needs that greater pre-tax income to net the 60000 needed to make the purchase. For this reason and because tax.

Its important to understand the step by step process when it comes to paying the lease as the premise of this arrangement is what underpins the benefits. The amount that will be included in your income if the care is leased will be the actual lease payments which. In this case also an employer is needed to maintain the official records of date of visit places visited petrol.

Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently. Tax benefits while leasing a car. Lets kick off with leasing benefits.

So what is the big. In India there is no option - you must buy the car at the end of the lease at the 5 residual value. Business electric vehicle leasing.

The actual benefits depend on the specifics of your business situation. For an unlimited company-car benefit the share of usage costs added to the basic value is reduced by. That means you must pay this additional amount with the agreement.

Out of this Rs. The potential tax benefits are only one of the considerations for business owners. FMC as lessor pay the dealer the 40000 balance.

Ultimately a vehicle purchase or lease is a big expense for your business so look at the problem from all. When you lease though youre doing so with pre-tax dollars. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

Note that while the excise tax on vehicle sales is processed through DC DMV the use tax for leases is processed through the DC Office of Tax and Revenue. One of the greatest advantages of leasing a car is typically lower. This is a massive incentive to switch and the tax relief may not be around forever.

Taxation of low-emission vehicles will change in some respects. Tax benefits on a car provided by the employer Updated on. Cars with lower emissions benefit from reduced Benefit In Kind at 2.

The buy option at the end of lease is also available abroad but it is an option. As you climb up the ladder in your profession it is commonly seen that the employer. 60month or 004km for plug-in hybrid vehicles including gasoline-electric hybrids and diesel-electric hybrids and for vehicles running on methane-based natural gas a.

Deduct a amount of Rs 2400 from the above figure for a car above 16 litres OR a amount of Rs 1800 for a car below 16 litres. Apart from the tax benefit there are more obvious advantages of. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

Check out whos eligible and how to claim. The lease payments are calculated so that over the three-year term they equal 40000 minus the residual value at the end of the lease plus interest on the difference. This means you only pay tax on the part of the car you lease not the entire value of the car.

That 60000 purchase costs your business 60000 and your lease. Unlike in USA and elsewhere car lease in India is actually a hire-purchase scheme. Some states require you to pay an additional tax on a car lease.

RCW 82090203 in Washington State requires an additional tax of 03 on the sale or lease of all motor vehicles. 200000 is your car lease amount and another Rs. Your monthly payment is based on the difference between the net capitalization cost 23000 and the 14820 at the end of the lease.

Tax benefits on Car Loans. If you use your leased vehicle for business purposes you can generally directly deduct the costs as business expenses monthly payments insurance mileage maintenance based on the percentage of business use versus non-business use. Every lease agreement has terms and conditions you must adhere to and at the end of the agreed-upon term you return the car to the leasing company.

The most common method is to tax monthly lease payments at the local sales tax rate. The computation of tax implications will be as follows. 150000 is allocated towards car maintenance insurance fuel and driver allowance.

350000 will be deducted from your taxable income and you will be liable to pay tax on Rs. First take note that under a normal car loan you would be paying it back after tax has been deducted from your income. However if you are buying a car for commercial use you can show the interest paid.

As previously mentioned business leasing can provide considerable tax benefits. Tax benefits on the car lease facility provided by the employer can be claimed depending on the ownership of the car and expenses incurred. Jan 13 2022 - 093824 AM.

Actual amount incurred by the employer. The lease terms are. Its referred to as the motor vehicle sales and lease tax.

This type of arrangement has several benefits that could make leasing a much better deal for you. You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of leasing can be deducted from taxable profits if the vehicle is considered a company car. As well as the Plug in Car Grant of 3000 for cars costing up to 50000 and the 350 grant towards home chargers tax relief is a major benefit said Harrop Marshall.

The residual value is calculated as 4688 of 40000 18752.

How To Pay Off Car Loan Faster Paying Off Car Loan Refinance Car Car Loans

The 6 Must Know Military Benefits Military Benefits Benefit Military Discounts

Donate Your Vehicle The Arc Of The Quad Cities Area Quad Cities Quad Vehicles

Top 10 Company Lease Cars Nationwide Vehicle Contracts Car Lease Lease Lease Deals

Things To Remember When Looking For A Co Signer Donate Car Car Loans Donation Tax Deduction

Printable Sample Lease Agreement Sample Form Real Estate Forms Lease Agreement Rental Agreement Templates

Mobile Marketing Airport Car Rental Sell Used Car Car Buying

Mary Kay Business Printable Pdf Mary Kay Tax Worksheet Mary Kay Mary Kay Mary Kay Printables Mary Kay Business

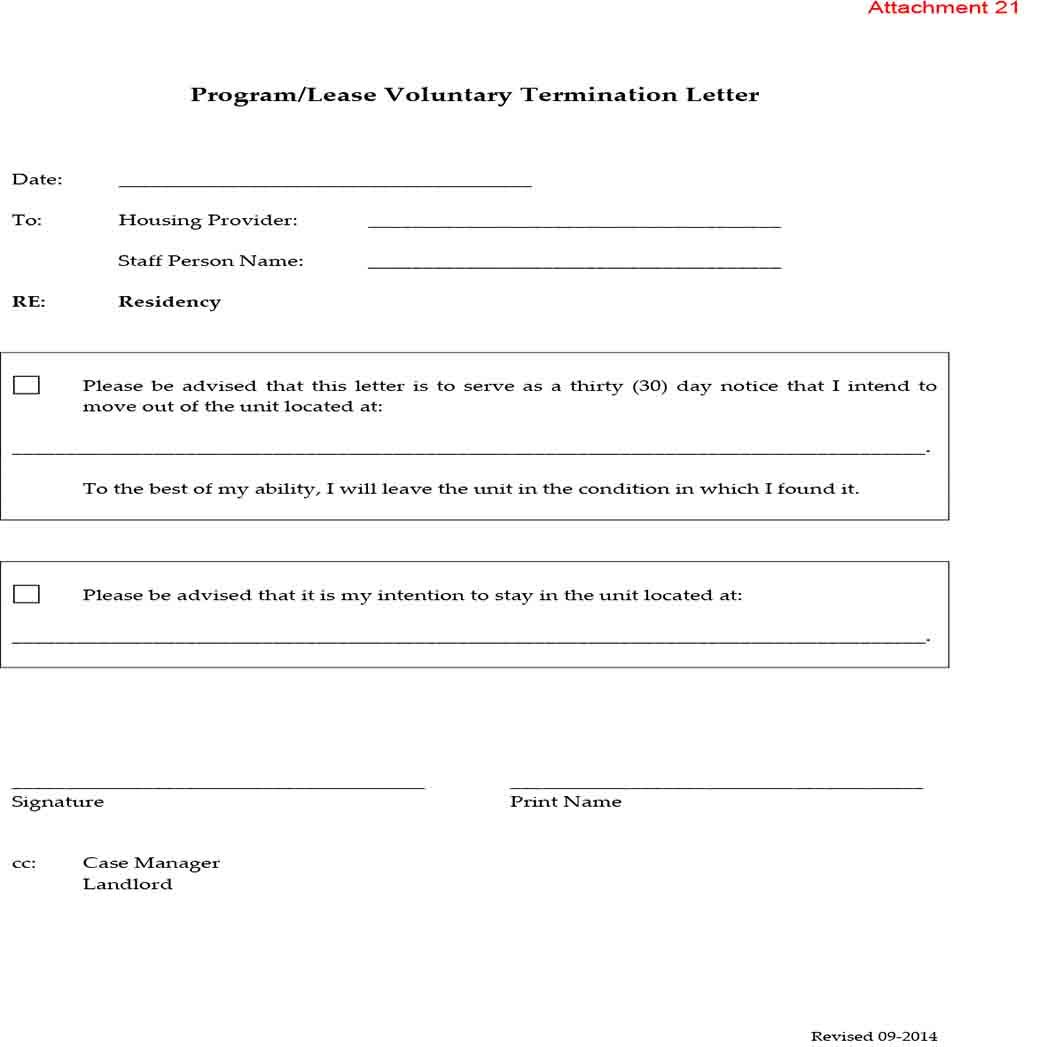

Program Lease Voluntary Termination Letter 1 Lettering Letter Example How To Make Letters

Benefits Of Vehicle Leasing In Corporates In India Fuel Cost Car Lease Fleet

Uber S Driver Expenses Uber Driver Uber Uber Driving

Is It Advantageous To Think Of Leasing Your Commercial Real Estate Commercial Property Commercial Real Estate Commercial

5 Benefits Of Leasing Electric Vehicles Car Lease Electric Car Lease Hybrid Car

Infographic Best Time To Buy A Car Car Buying Buying New Car Car Buying Guide

Car Rental In Singapore Car Rental Car Rental Company Car Personalization

The Pros Cons And Economics Of Leasing Vs Buying A Car Car Buying Financial Decisions Economics

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax Nanny

Trade It Junk It Or Give It To Charity Car Trade Car Prices Car Buying Tips